Page 86 - KEX EXPRESS (THAILAND) PUBLIC COMPANY LIMITED : ANNUAL REPORT 2024

P. 86

86 ONE REPORT (FORM 56-1) 2024

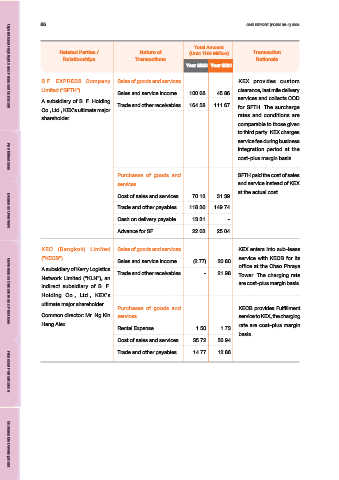

Total Amount

Related Parties / Nature of (Unit: THB Million) Transaction

Relationships Transactions Rationale

Year 2023 Year 2024

S.F. EXPRESS Company Sales of goods and services KEX provides custom

Limited (“SFTH”) clearance, last mile delivery

Sales and service income 100.68 45.86

A subsidiary of S. F. Holding Trade and other receivables 164.58 111.67 services and collects COD

Co., Ltd., KEX’s ultimate major for SFTH. The surcharge

Operational Highlights and Financial Summary

shareholder rates and conditions are

comparable to those given

to third party. KEX charges

service fee during business

integration period at the

cost-plus margin basis.

Key Milestones

Purchases of goods and SFTH paid the cost of sales

services and service instead of KEX

at the actual cost.

Cost of sales and services 70.13 31.39

Trade and other payables 118.36 149.74

Cash on delivery payable 13.31 -

Advance for SF 22.03 25.04

Business Overview

KEC (Bangkok) Limited Sales of goods and services KEX enters into sub-lease

(“KECB”) service with KECB for its

Sales and service income (2.77) 20.80

A subsidiary of Kerry Logistics Trade and other receivables - 21.98 office at the Chao Phraya

Network Limited (“KLN”), an Tower. The charging rate

indirect subsidiary of S. F. are cost-plus margin basis.

Holding Co., Ltd., KEX’s

ultimate major shareholder

Purchases of goods and KECB provides Fulfillment

Common director: Mr. Ng Kin services service to KEX, the charging

Hang Alex rate are cost-plus margin

Governance Structure and Practices

Rental Expense 1.50 1.73

basis.

Cost of sales and services 35.72 56.94

Trade and other payables 14.77 12.86

Financial Performance

Sustainable Development